The “growth ceiling” problem for Philippine SMEs often stems from limited access to capital and business loan companies in the Philippines; these situations hinder their ability to scale operations and seize market opportunities. Many small businesses struggle to transition from a micro or small status to achieving significant revenue milestones. That is why some SMEs usually cling to strategic financing like SME loans in the Philippines that can effectively break this ceiling by providing them the necessary resources to invest in growth initiatives, optimize operations, and enhance market presence.

This article by Zenith Capital outlines a step-by-step playbook or path for SMEs to navigate their scaling journey, emphasizing that success is not merely about securing a loan, but about using capital strategically to drive sustainable growth. By leveraging financial solutions thoughtfully and helping entrepreneurs like you to unlock your full potential and propel your businesses to new heights.

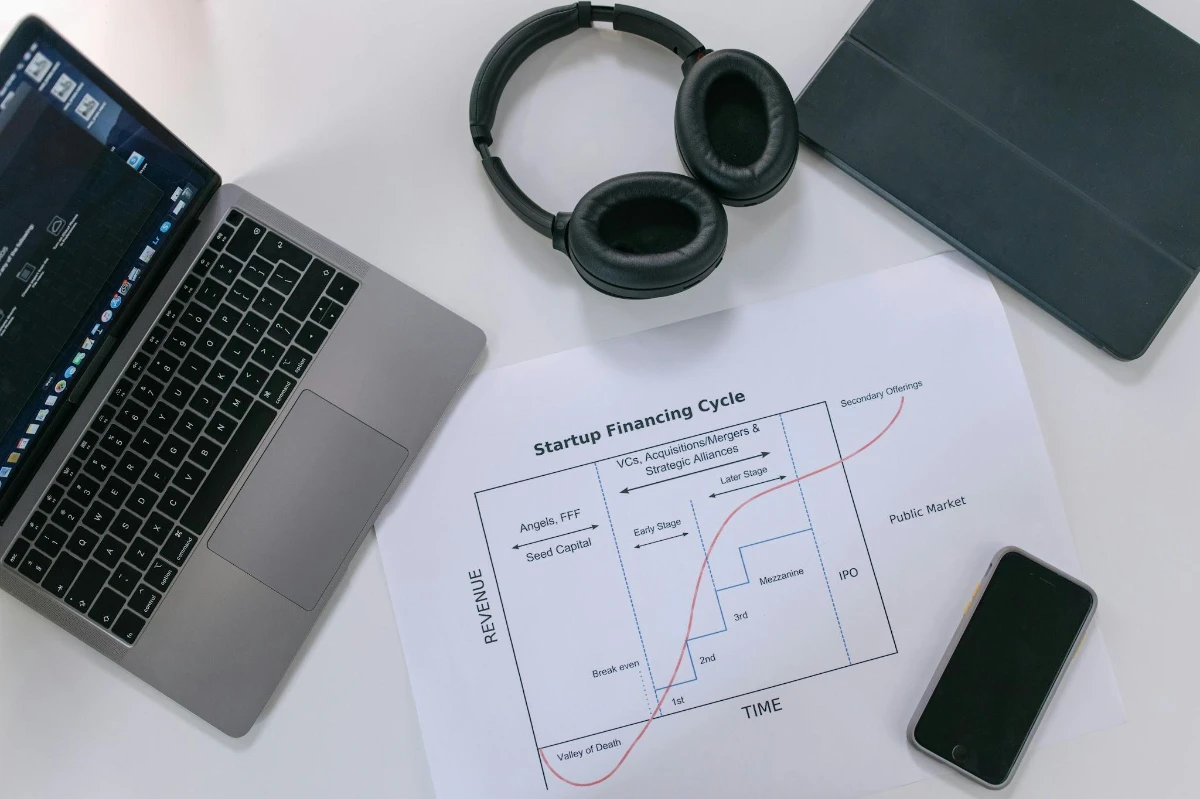

Understanding the SME Growth Stages

Photo courtesy of RDNE Stock Project via Pexels

Photo courtesy of RDNE Stock Project via Pexels

There are different stages of SME growth that have distinct capital needs. This is due to the varying operational challenges and objectives that small businesses face as they evolve. It is important for you to understand that these different SME growth stages are crucial for developing appropriate financing strategies that are aligned with each stage’s requirements.

Survival Stage (₱0–₱2M/year): In this initial stage, SMEs often face unstable cash flow and a high dependence on the owner when it comes to critical decision-making and day-to-day business operations. The primary focus of this stage is establishing a customer-based business that generates enough revenue to cover the basic expenses of the business, making it a challenging period where many businesses struggle to maintain viability.

Stability Stage (₱2M–₱10M/year): As the businesses progress to this so-called “stability stage”, business owners are beginning to experience predictable revenue streams that they can use to establish a viable business model. This stage is crucial for systemization, as the business can now implement basic processes and structures to reduce reliance on the owner’s direct involvement, setting the foundation for future growth.

Expansion Stage (₱10M–₱50M/year): During this expansion stage, the demand for the business products or services often exceeds its current capacity to deliver. The businesses in this stage must now focus on scaling the operations, hiring additional staff or manpower, and possibly investing in new technologies or infrastructure to meet the growing customer demand and capitalize on the market opportunities.

Scale Stage (₱50M–₱100M/year): In the scale stage of the business, SMEs are now starting to pursue aggressive expansion strategies. They often explore multi-branch or multi-channel operations. This stage in the business requires a significant amount of investment in resources and infrastructure to support the rapid growth, as SMEs aim to solidify their market presence and enhance operational efficiency while managing the complexities that come with their large-scale operations.

As businesses progress through these stages, their financing strategies must evolve to align with their changing capital needs, growth objectives, and operational complexities. A well-structured approach by businesses toSME financingnot only supports their immediate needs but also positions their business for long-term success by enabling strategic investments that drive sustainable growth.

Why Financing Is Essential for Scaling

Photo courtesy of Ivan S via Pexels

Photo courtesy of Ivan S via Pexels

Capital plays a crucial role in breaking growth barriers for SMEs by addressing several key challenges that can hinder expansion. Here are some reasons why SME business loans in the Philippines are being used by business owners as a tool in scaling up their business:

- Inventory Limitations: Adequate capital enables businesses to invest in inventory, ensuring they can meet customer demand. This helps capitalize on sales opportunities while maintaining customer loyalty and satisfaction.

- Cash Flow Gaps: Access to capital helps businesses to bridge their cash flow gaps that can arise from delayed customer payments or unexpected expenses. By securing short-term financing, business owners can cover their operational costs and avoid disruptions that could impede their business growth.

- Underinvestment in Marketing: Adequate funding allows businesses to invest in marketing strategies, expand their market reach, and attract new customers, ultimately driving revenue growth.

- Failure to Expand Production Capacity: Capital is necessary for expanding and upgrading business facilities. Businesses can use the borrowed capital and invest it by purchasing new equipment or adopting more efficient production processes. These investments allow businesses to increase production capacity and to meet the rising demand of their customers effectively.

- Inability to Hire Skilled Staff: With adequate capital, businesses can attract new employees and also retain skilled employees by offering them competitive salaries and benefits. A strong workforce is vital for driving innovation and operational efficiency.

- Slow Tech Adoption: Capital facilitates the adoption of new technologies that improve efficiency and streamline business operations. Investing in modern tools and systems can enhance business productivity that providing a competitive edge in the market.

Ultimately, businesses don’t scale simply because they want to; they scale because they have the capital to seize business opportunities. Access to funding through business loans empowers SMEs to overcome these “growth ceiling” barriers, enabling them to invest strategically in growth initiatives and achieve their business expansion goals.

Strategic Use of Capital: The 5 Growth Levers

1. Inventory Scaling

Adding capital increases order capacity, allowing businesses to purchase more inventory upfront. This is essential for meeting customer demand and maximizing sales opportunities. For example, a business with ₱200k in stock may struggle during peak demand. WithSME financing, it could increase inventory to ₱500k, serve more customers, and capture higher sales. This boost in capacity can significantly increase monthly revenue and turn inventory investment into a sustainable growth driver.

2. Marketing and Customer Acquisition

Paid ads create a predictable growth engine by targeting specific audiences and tracking results. Additional funding lets businesses scale marketing quickly by allocating resources to high-performing campaigns. For instance, investing ₱50k in a targeted Facebook campaign can drive consistent returns and attract new customers. By monitoring metrics like cost per acquisition and return on ad spend, businesses can refine strategies and focus on campaigns that deliver predictable growth.

3. Operations & Systems

Businesses usecorporate financingto upgrade systems such as POS, ERP, and other digital tools, which improve operational efficiency. Systemized operations streamline processes, reduce errors, and enhance data accuracy. For example, a retail business investing in an integrated POS and ERP system can manage inventory, sales, and customer data more effectively. This efficiency supports faster scaling, allowing the business to handle higher sales volumes without proportional increases in operational costs.

4. Hiring and Talent Growth

Financing enables strategic hires critical for growth, such as operations heads, marketing leads, or store managers. For example, a growing retail chain might use a loan to hire key staff, improving operations and increasing sales by 30% in six months. Financing payroll during expansion also helps maintain employee morale and productivity without cash flow interruptions, ensuring the business grows smoothly.

5. Multi-Branch or Multi-Channel Expansion

Strategic financing is vital for businesses looking to expand their footprint. It helps fund new locations and reach additional customers. For example, a café chain might secure financing to open three new branches in high-traffic areas, boosting market presence and revenue potential.

Financing also supports e-commerce growth. Businesses can enhance their online platforms, invest in digital marketing, and improve logistics. A fashion retailer, for instance, could use funding to revamp its e-commerce site and launch targeted campaigns, resulting in a 50% increase in online sales within a year.

Finally, strategic financing aids financial planning. Startups can develop realistic budget templates outlining projected expenses and revenue. Financing ensures they cover initial costs while scaling operations, helping the business stay on track and make informed growth decisions.

Financing Mistakes That Kill Growth

Common Pitfalls in Financing Decisions

- Underborrowing, Causing Stalled Expansion: When businesses fail to secure enough capital to support their growth plans, they may miss out on opportunities to expand their business operations or to enter new markets. This business pitfall can lead to stagnation and inability of the business to compete in the market effectively.

- Overborrowing with Unclear ROI: Conversely, taking on too much debt without a clear understanding of the expected return on investment can lead to financial strain not only to the business but also to the owners. Businesses may find themselves unable to meet repayment obligations if the anticipated revenue does not materialize, leading to the closure of the business due to bankruptcy.

- Using Debt for Non-Income Producing Expenses: Financing non-essential or non-income-generating expenses, such as luxury office renovations or excessive marketing without a clear strategy, can divert resources away from critical growth initiatives, jeopardizing the financial stability of the business.

- Not Calculating Full Repayment Cost: Failing to account for the total cost of borrowing, including interest rates and fees, can lead to cash flow issues. Businesses or corporations may underestimate their repayment obligations, resulting in financial distress.

- Poor Cash Flow Management: Ineffective cash flow management can exacerbate financing challenges. Businesses that do not monitor their cash inflows and outflows may struggle to make timely loan payments, leading to penalties because of default and losing the collateral for the loan.

- Relying Solely on One Financing Source: Depending on a single source ofbusiness loans in the Philippinescan be risky. If that source becomes unavailable or changes its terms, businesses may find themselves without the necessary capital to operate or grow.

Real Scenarios Illustrating Poor Financing Decisions

- Scenario 1: Underborrowing Leading to Stalled Expansion

A small manufacturing company aimed to expand its production capacity to meet increasing demand. However, the owner decided to borrow only ₱1 million, believing it would be sufficient. As demand surged, the company quickly realized that the funds were inadequate for purchasing new machinery and hiring additional staff. Consequently, the business could not fulfill orders on time, leading to lost customers and revenue, ultimately stalling its growth. - Scenario 2: Overborrowing with Unclear ROI

A tech startup secured a ₱5 million loan to develop a new software product, but the owner did not conduct thorough market research to assess demand. The product launch was met with lukewarm interest, and the expected sales did not materialize. With high monthly repayments and no clear path to profitability, the startup struggled to manage its debt, leading to financial distress and eventual bankruptcy. This scenario highlights the dangers of overborrowing without a solid understanding of potential returns. - Scenario 3: Using debt for non-income-producing expenses

A retail chain secured a capital loan from a private lending firm for the purchase of its inventory and payment for advertising expenses. Instead of injecting it into these investments, the business owner decided to divert the funds for shop renovation, beautification, and the purchase of expensive office equipment. If the business owner had invested it in inventories and marketing, there is a better chance that the business would have generated profit. - Scenario 4: Not Calculating full repayment cost

A cafe owner just secured a loan for the expansion of the business, without conducting a feasibility study or computing the repayment cost from the bank. And in opening the new branch, the business is experiencing the survival stage of the business and sales are low. The business owner will have a hard time repaying the loan and will be forced to use the cash flow of the other cafe branch to repay the loan. - Scenario 5: Poor Cash Flow Management

Using Scenario #4, the owner will now be using the funds of other branches to repay the loan acquired in establishing the new branch, and worse, the owner will also be using personal funds. This co-mingling of funds will result in the disruption of the cash flow of other cafe branches, which can lead to the financial instability of the whole business. - Scenario 6: Relying on One Financing Source

Business owners will have a hard time negotiating interest rates and terms of payments and loans with one financing source. There are no other options given to the business owner; it is a “take-it or leave-it” situation.

How to Build a Smart Financing Strategy

SMEs should adopt a proactive approach tobusiness loans in the Philippinesby planning their capital needs rather than reacting to emergencies. This strategic mindset enables businesses to align their financial resources with growth objectives, ensuring they have the necessary funds to seize opportunities and navigate challenges effectively. Here are the key steps to develop a comprehensive financing plan:

Steps to Plan Financing

- Assess Your Growth Ceiling: Evaluate the current limitations of your business, including operational capacity, market demand, and financial resources. Understanding where your growth potential is capped will help identify the necessary capital to break through these barriers.

- Calculate Capital Requirement per Lever: Determine the specific capital needed for various growth levers, such as inventory expansion, marketing initiatives, technology upgrades, and hiring skilled staff. This calculation should be based on realistic projections of costs and expected returns.

- Choose Financing Mix: Identify the most suitable sources of financing or business loans, which may include traditional bank loans, private lenders, or government grants. A diversified financing mix can mitigate risks and provide flexibility in accessing funds.

- Build Repayment Plan Aligned with Projected Revenue: Develop a repayment strategy that aligns with your revenue forecasts. This plan should consider cash flow cycles and ensure that loan repayments are manageable within the context of your expected income.

- Track ROI per Loan Cycle: Monitor the return on investment for each financing cycle to assess the effectiveness of your capital use. This tracking will help you make informed decisions about future financing needs and adjustments.

- Use Financing Cycles Strategically: Leverage financing in alignment with your business cycles, such as inventory cycles and sales cycles. For example, securing funding before peak sales seasons can help ensure you have adequate stock to meet demand.

The Role of Private Financing in Scaling Quickly

Private financing companies play a critical role in supporting SMEs during their early and expansion stages by providing accessible and timely funding solutions tailored to the unique needs of growing businesses. Here’s how they contribute to this process:

Importance of Private Financing Companies

- Fast Approval (as fast as 2 days): One of the key advantages of private financing companies is their ability to provide quick approvals, often within just two days. This rapid response is essential for businesses that need immediate capital to seize opportunities or address urgent financial needs.

- Loans from ₱100k–₱1M: Private lenders typically offer loans in the range of ₱100k to ₱1M, which is ideal for SMEs looking for manageable amounts of capital to fund specific projects or initiatives without taking on excessive debt.

- Flexible Requirements: Unlike traditional banks, private financing companies often have more flexible requirements, making it easier for SMEs to qualify for loans. This flexibility is crucial for businesses that may not have extensive credit histories or substantial financial documentation.

- Collateral-Free: Many private lenders offer collateral-free loans, which reduces the risk for business owners who may not have significant assets to secure financing. This feature allows entrepreneurs to access funds without jeopardizing personal or business assets.

- Ideal for Cash Flow Cycles, Seasonal Demand, and Expansions: Private financing is particularly beneficial for managing cash flow cycles, addressing seasonal demand fluctuations, and funding expansion efforts. This adaptability enables businesses to respond quickly to changing market conditions and growth opportunities.

In summary, private financing companies are critical for SMEs in their early and expansion stages, offering fast, flexible, and accessible funding solutions that enable businesses to respond to immediate needs and capitalize on growth opportunities.

Apply for a Loan with Zenith Capital today!

In conclusion, scaling a business to reach ₱100M in revenue is a strategic journey that requires careful planning and capital backing. Relying solely on cash flow is often insufficient to seize growth opportunities and navigate the complexities of expansion. To effectively support your growth ambitions, it is essential to partner with a trusted SME loan provider in the Philippines that can provide the necessary financing solutions tailored to your unique needs. By leveraging strategic capital, you can unlock your business’s full potential and achieve sustainable growth in today’s competitive landscape.

ExploreZenith CapitalKa-Azenso SME Quick Loan for financing amounts from ₱100,000 to ₱1,000,000 with fast processing and minimal requirements.

Start growing and expanding your business with Zenith Capital!