Comparing Business Loan Interest Rates in the Philippines: What to Expect This Year

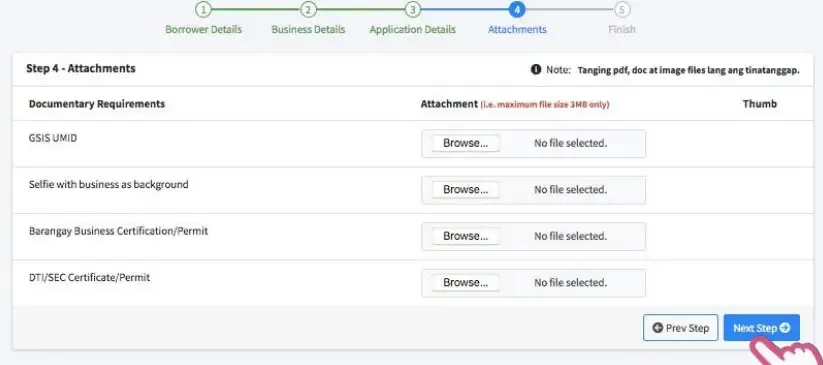

For many Filipino entrepreneurs, getting a business loan is the bridge between opportunity and success. Whether you’re restocking inventory, purchasing new equipment, or expanding to a second branch, the right financing can drive business growth. But before signing any loan agreement, one question matters most: how much will it really cost you? This cost comes […]

Comparing Business Loan Interest Rates in the Philippines: What to Expect This Year Read More »