Did you know that over 1 million businesses are actively operating in the Philippines? These enterprises serve as the driving force behind the nation’s thriving economy. Amid this bustling corporate landscape, many seek to incorporate to reach the next level.

But how does a venture go from a startup to a corporation? The answer lies in proper registration—a pivotal step often underestimated in complexity and significance. This journey from inception to incorporation contains many potential hurdles you can avoid with enough preparation and guidance.

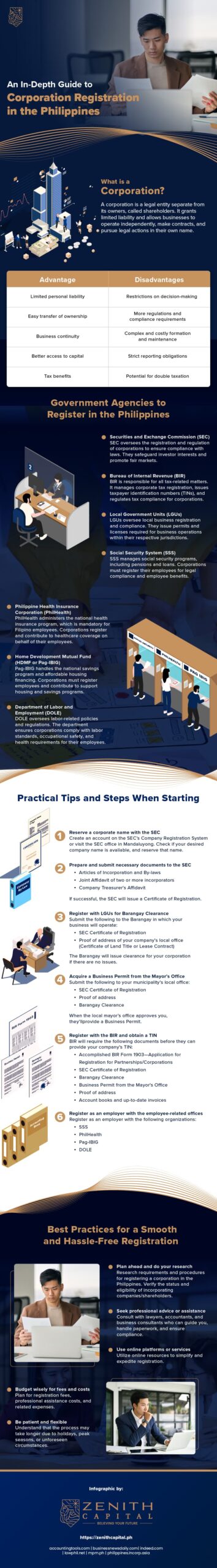

If you’re eager to level up your business, this infographic contains everything you need to know about corporation registration in the Philippines.

What is a Corporation?

A corporation is a legally distinct entity from its owners, granting limited liability protection. It enables businesses to operate independently, draft contracts, and pursue legal actions. Shareholders can invest in the corporation, enjoying the benefits of ownership while shielding personal assets from the company’s liabilities.

Advantages and Disadvantages of Corporations

A registered corporation in the Philippines receives unique benefits that can make it an attractive option for Filipino entrepreneurs. However, they can come with corresponding drawbacks, namely:

1. Limited personal liability vs. Restrictions on decision-making

An incorporated structure’s limited personal liability shields individual assets from business debts. However, while the owners get personal protection, the shared decision-making process within a corporation might limit the autonomy of individual stakeholders.

2. Easy transfer of ownership vs. More regulations and compliance requirements

The convenience of transferring ownership within corporations through stocks fosters flexibility. Yet, this ease comes with heightened regulatory demands and compliance requirements, necessitating meticulous adherence to legal formalities during ownership transitions.

3. Business continuity vs. Complex and costly formation and maintenance

Corporations aid business continuity due to their separation from individual shareholders, but the added complexity and expenses in establishing and maintaining the corporation can challenge operational resilience.

4. Better access to capital vs. Strict reporting obligations

A corporation can have an easier time accessing capital than sole-ownership businesses by issuing stocks or bonds or attracting investors. However, in return for handling considerable sums of money, corporations face rigorous reporting obligations that can add to the administrative burden.

5. Tax benefits vs. Potential for double taxation

Corporations receive tax benefits, such as business expense deductions and strategic tax planning opportunities. There’s a cost to it, though. Double taxation can occur, where profits are taxed both at corporate and shareholder levels.

Government Agencies to Register in the Philippines

Registering a corporation in the Philippines involves engagement with various government agencies, each playing a crucial role in a corporation’s legal and operational compliance.

Securities and Exchange Commission (SEC)

SEC oversees corporate registrations. As the overall observer and manager of the compliance laws and regulations governing corporations, this organization approves business registrations, monitors compliance, and protects investors by ensuring transparency and disclosure.

Bureau of Internal Revenue (BIR)

BIR controls everything related to the corporation’s taxes. It issues taxpayer identification numbers (TINs), handles tax assessments, and regulates tax payments and filings for corporations. You’ll also interact with BIR often as it manages annual business renewals.

Local Government Units (LGUs)

Including the Barangay Hall and the Office of the Mayor, they play a pivotal role in local business registration and compliance. These sectors issue permits and licenses required for businesses to operate within their specific jurisdictions, ensuring adherence to local regulations.

Social Security System (SSS)

SSS manages its namesake program, and part of its role involves corporations registering their employees for social security benefits. In return for regular, legally mandated contributions, the organization provides pensions and loans for all employees.

Philippine Health Insurance Corporation (PhilHealth)

PhilHealth administers the national health insurance program, which the government requires corporations to participate in for their employees’ welfare. Corporations register with PhilHealth and make contributions to ensure comprehensive health coverage for their employees and compliance with healthcare regulations.

Home Development Mutual Fund (HDMF or Pag-IBIG)

Pag-IBIG Fund is a national savings program and affordable housing financing initiative. Corporations must register employees and make contributions on their behalf to assist them with savings. They also have access to housing loan programs through this organization.

Department of Labor and Employment (DOLE)

DOLE is the guardian of labor-related policies and regulations. It ensures corporations meticulously adhere to labor standards, occupational safety protocols, and health requirements. The department actively monitors and enforces these standards to foster a safe and fair corporate work environment.

Requirements and Steps for Registering a Corporation in the Philippines

The corporation registration process is quite similar to company registration in the Philippines. It’s a multi-step undertaking that demands attention to detail and compliance with various governmental agencies. Here’s a breakdown of the registration process of corporations.

1. Reserve a corporate name with the SEC

A great business idea needs a unique name. Start by creating an account on the SEC’s Company Registration System or visit their office in Mandaluyong. Ensure your desired name aligns with SEC guidelines, isn’t already in use, and doesn’t violate naming conventions or trademarks.

Common mistakes involve choosing names that have already been taken or not adhering to naming regulations. It would be best to have multiple name options ready, just in case.

2. Prepare and submit necessary documents to the SEC

Get into the nitty-gritty by preparing the following requirements for SEC approval:

- Articles of Incorporation

- By-laws

- Joint Affidavit of Incorporators

- Company Treasurer’s Affidavit

You may also need to arrange other requirements, such as your business plan, objectives, and working capital details. Mistakes often involve incomplete documents, errors in articles, or discrepancies in submitted information. Always triple-check your files before submission or seek professional assistance.

3. Register with LGUs for Barangay Clearance

Getting Barangay Clearance requires presenting the SEC Certificate of Registration you received for completing the previous step and proof of your company’s local office address. The latter comes as either a Certificate of Land Title for owned property or a Lease Contract for rented land.

4. Acquire a Business Permit from the Mayor’s Office

Next, you’ll have to submit the following to receive a local business permit from the mayor’s office:

- SEC Certificate of Registration

- Proof of Address

- Barangay Clearance

Be careful of incomplete submissions or other specific municipality requirements.

5. Register with the BIR and obtain a TIN

With your previously acquired documents, it’s now time for the BIR. Fill out BIR Form 1903 thoroughly and without any inaccuracies. The agency may also request other financial papers, such as the incorporating entities’ account books and other cash flow documents.

6. Register as an employer with the employee-related offices

As a corporation that will be handling many employees, use the gathered documents to register officially as an employer with the following organizations:

- SSS

- PhilHealth

- Pag-IBIG

- DOLE

Be sure to maintain organized employee-related records and not to confuse each agency’s requirements.

Best Practices for a Smooth and Hassle-Free Registration

Here are tips to navigate the registration process smoothly and avoid future headaches:

Plan ahead and do your research

Before diving into registration, thoroughly understand the requirements and procedures. Check the most up-to-date guidelines for each step in the process. Also, assess your stakeholders’ eligibility for incorporation and ensure your house is in order before you begin.

Seek professional advice or assistance

Engage professionals such as lawyers, accountants, and business consultants proficient in corporate registrations. Their expertise streamlines the process, guides you through complexities, and handles paperwork efficiently.

Use online platforms or services

Leverage online resources to streamline and expedite registration. Online platforms let you do most of the process from the comfort of your home, skipping the lines and speeding up the documentation processes.

Budget wisely for fees and costs

Anticipate and allocate funds for registration fees, professional services, and other related expenses. This process can be expensive, so set aside a decent amount to prevent surprises. You might consider a short and long term loan.

Be patient and flexible

Recognize that handling the bureaucracy of several government agencies is by no means a fast process. You can encounter delays due to holidays, peak seasons, or unexpected circumstances. Maintain flexibility and patience to navigate potential setbacks—keep your end goal in mind!

Your Corporation, Officially in Motion

With your corporation dreams finally in motion, remember the necessity of starting it on the right foot. Before getting a loan, it is important to ensure a well-registered entity can pave the way for growth and stability while safeguarding your assets.

As your business gains momentum, partnering with trusted experts like Zenith Capital amplifies your progress. We provide tailored business loans in the Philippines for any financial assistance you may need, may be it a small business loans and enterprise loan. Contact us to learn more and apply for a loan today!

Rizza Templonuevo is not just an accomplished finance professional and business leader, but also a loving wife and a dedicated mother of two. With a passion for helping businesses grow and thrive, she brings her extensive knowledge and expertise as Vice President of Zenith Capital Credit Group Corporation to help countless SMEs and corporations across the Philippines access the financing they need to succeed.

When she’s not busy with work, Rizza enjoys immersing herself in the worlds of fashion and social events, as well as traveling to new and exciting places.