What are DTI Loans, and Who Can Apply for Them?

DTI loans are financial instruments specifically designed to support the growth and development of MSMEs. These loans differ from traditional bank loans in several ways, namely:

- Low-interest ratesDTI loans typically feature significantly lower interest rates than private loans, making them more affordable for small businesses.

- Minimal collateralMany DTI loan programs require little to no collateral, reducing small business owners’ financial burden and risk.

- Easy application processThe DTI has streamlined and simplified its application process to enhance accessibility for businesses of all sizes.

- Wider coverageDTI loans cover various sectors, industries, and purposes, making them versatile for multiple business needs.

DTI loan for MSMEs

DTI offers a range of loan programs to cater to the diverse needs of MSMEs. Two notable programs are:

1. P3 (Pondo sa Pagbabago at Pag-asenso)

The P3 program discourages microentrepreneurs from borrowing from loan sharks and predatory lenders.

- Eligibility:Micro and small enterprises, including micro-entrepreneurs (sari-sari stores and stall owners), running for at least one year.

- Loan amount and terms:₱5,000 to ₱200,000 for microenterprises with a monthly interest rate of 2.5% and no processing fees.

2. RISE UP

RISE UP is a versatile loan program that comes in three distinct types.

- Micro Multi-Purpose Loan

- Eligibility: Microenterprises operating for at least one year and no existing loans over ₱100,000.

- Loan amount and terms: Up to ₱300,000, repayable over three years with a 12-month grace period and an annual interest rate of 12% on the diminishing balance.

- SME First-Time Borrowers

- Eligibility: SME owner who has positive net income in the last year. Prioritizes first-time borrowers.

- Loan amount and terms: Up to ₱20,000,000 collateral-based or up to ₱5,000,000 collateral-free loans, repayable over three years with a 12-month grace period, at an annual interest rate of 12% on the diminishing balance.

- MSME Multi-Purpose Suki Loan

- Eligibility: MSMEs with BIR-filed Financial Statements (for loans exceeding ₱3,000,000) and prior borrowers from SB Corp.

- Loan amount and terms: Up to ₱20,000,000 with collateral or ₱5,000,000 collateral-free, repayable over five years with a 12-month grace period, at an annual interest rate of 8% to 12% on the diminishing balance.

DTI loans for MSMEs provide financial assistance tailored to different small businesses, with some programs prioritizing specific industries or groups, like tourism or agriculture, receiving additional funding.

DTI Loan Application: Requirements, Steps, and Tips

Securing a DTI loan is an exciting and potentially transformative move for your business. Here are a few steps to ensure a smooth application process.

1. Research and preparation

Before applying, take time to understand the specific DTI program you’re interested in. These programs serve diverse business needs and come with specific eligibility criteria. For example, if you’re looking to manage cash flows, a smaller loan like the P3 might be better suited than a larger one like the MSME Multi-Purpose Suki Loan.

Evaluate your options carefully and choose the one that best aligns with your goals. Also, you should have a well-prepared business plan, even a laundry business franchise needs one, that clearly outlines how you intend to use the loan funds.

You can consult DTI’s Negosyo Center for guidance on selecting the most suitable loan program and crafting your business plan.

2. Online registration

Start the process by registering online through the SB Corp Borrower Registration System (BRS) website. Be meticulous when filling out the necessary forms, ensuring all details are accurate and up-to-date. This website is your digital gateway for managing your DTI loan.

To avoid delays, it would be best to have all your DTI loan application requirements, information, and documents ready before you begin. Don’t be afraid to open the form to see what you may be missing; always double-check your data for accuracy.

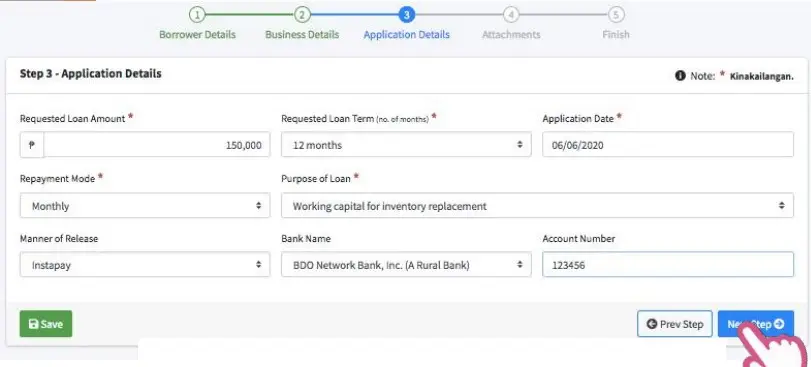

Here’s a filled-in version of the 3rd page of the form for your reference:

Source: BRS Instruction Manual

3. Complete application form

The application form is the most critical requirement for a DTI loan. Ensure you provide comprehensive and accurate business information, including your business name, registration details, and chosen loan program.

While there might be a temptation to exaggerate some details to present your business in a better light, you must remember that honesty is always the best policy.

Remember to review all information thoroughly before submissions. Take your time to fill out the form, and don’t be afraid to seek assistance if needed. Accuracy is more important than speed, as errors could lead to delays or rejection.

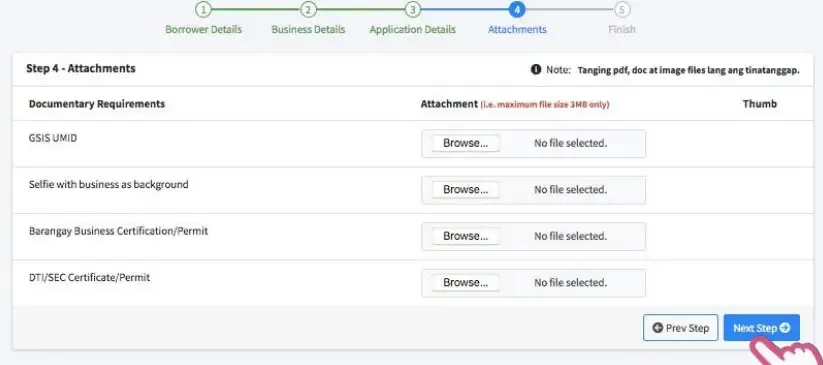

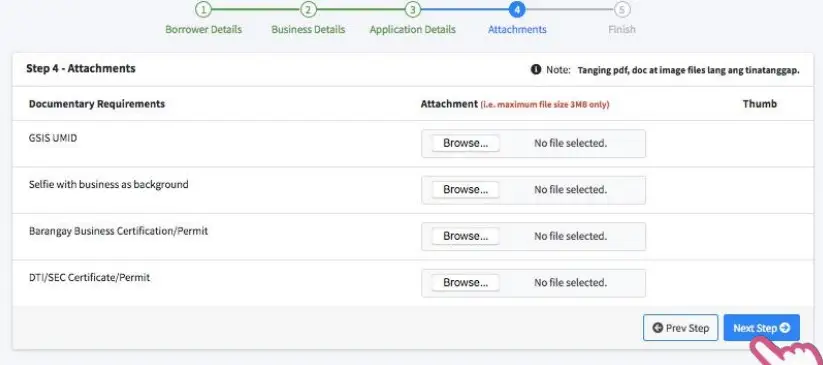

4. Upload all required documents

DTI loans typically require specific documents to support your application, such as business or barangay permits, financial statements, and project proposals. You should organize your documents neatly and upload them according to the provided guidelines, keeping in mind that the maximum file size per upload is 3 MB.

Here’s a picture of the uploading step for your reference:

Source: BRS Instruction Manual

5. Submission and confirmation

After completing the application form and uploading the necessary documents, submit your application. You should receive a confirmation indicating that they’ve received your application. Be patient, as DTI may require time to review your submission.

Stay vigilant for any updates or inquiries from the agency. Check your email and be prepared to provide additional information if requested.