How to Apply DTI Loan Online: Step-by-Step Guide for Small Businesses

What are DTI Loans, and Who Can Apply for Them?

Understanding how to apply DTI loan online is crucial for small business owners looking to expand their operations. DTI loans are financial instruments specifically designed to support the growth and development of SMEs in the Philippines. Unlike traditional bank loans, these government-backed financing options provide more accessible terms, lower interest rates, and faster approval processes—making them ideal for entrepreneurs facing small business financial challenges. By securing the right funding, businesses can effectively manage cash flow, invest in marketing strategies for small businesses in the Philippines, and even explore opportunities such as a grocery franchise or a travel agency franchise in the Philippines.

-

Low-interest rates

DTI loans typically feature significantly lower interest rates than private loans, making them more affordable for small businesses.

-

Minimal collateral

Many DTI loan programs require little to no collateral, reducing small business owners’ financial burden and risk.

-

Easy application process

The DTI has streamlined and simplified its application process to enhance accessibility for businesses of all sizes.

-

Wider coverage

DTI loans cover various sectors, industries, and purposes, making them versatile for multiple business needs.

DTI loan for MSMEs

DTI offers a range of loan programs to cater to the diverse needs of MSMEs. Two notable programs are:

1. P3 (Pondo sa Pagbabago at Pag-asenso)

The P3 program discourages microentrepreneurs from borrowing from loan sharks and predatory lenders.

-

Eligibility:

Micro and small enterprises, including micro-entrepreneurs (sari-sari stores and stall owners), running for at least one year.

-

Loan amount and terms:

₱5,000 to ₱200,000 for microenterprises with a monthly interest rate of 2.5% and no processing fees.

2. RISE UP

RISE UP is a versatile loan program that comes in three distinct types.

-

Micro Multi-Purpose Loan

- Eligibility: Microenterprises operating for at least one year and no existing loans over ₱100,000.

- Loan amount and terms: Up to ₱300,000, repayable over three years with a 12-month grace period and an annual interest rate of 12% on the diminishing balance.

-

SME First-Time Borrowers

- Eligibility: SME owner who has positive net income in the last year. Prioritizes first-time borrowers.

- Loan amount and terms: Up to ₱20,000,000 collateral-based or up to ₱5,000,000 collateral-free loans, repayable over three years with a 12-month grace period, at an annual interest rate of 12% on the diminishing balance.

-

MSME Multi-Purpose Suki Loan

- Eligibility: MSMEs with BIR-filed Financial Statements (for loans exceeding ₱3,000,000) and prior borrowers from SB Corp.

- Loan amount and terms: Up to ₱20,000,000 with collateral or ₱5,000,000 collateral-free, repayable over five years with a 12-month grace period, at an annual interest rate of 8% to 12% on the diminishing balance.

DTI loans for MSMEs provide financial assistance tailored to different small businesses, with some programs prioritizing specific industries or groups, like tourism or agriculture, receiving additional funding.

DTI Loan Application: Requirements, Steps, and Tips

Securing a DTI loan is an exciting and potentially transformative move for your business. Here are a few steps to ensure a smooth application process.

1. Research and Preparation

Before applying, take time to understand the specific DTI program you’re interested in. These programs serve diverse business needs and come with specific eligibility criteria. For example, if you’re looking to manage cash flows, a smaller loan like the P3 might be better suited than a larger one like the MSME Multi-Purpose Suki Loan.

Evaluate your options carefully and choose the one that best aligns with your goals. Also, you should have a well-prepared business plan, even a laundry business franchise needs one, that clearly outlines how you intend to use the loan funds.

You can consult DTI’s Negosyo Center for guidance on selecting the most suitable loan program and crafting your business plan.

2. Online Registration

Start the process by registering online through the SB Corp Borrower Registration System (BRS) website. Be meticulous when filling out the necessary forms, ensuring all details are accurate and up-to-date. This website is your digital gateway for managing your DTI loan.

To avoid delays, it would be best to have all your DTI loan application requirements, information, and documents ready before you begin. Don’t be afraid to open the form to see what you may be missing; always double-check your data for accuracy.

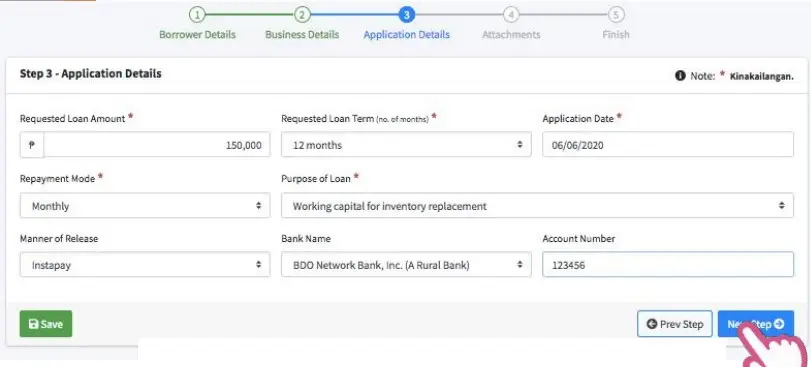

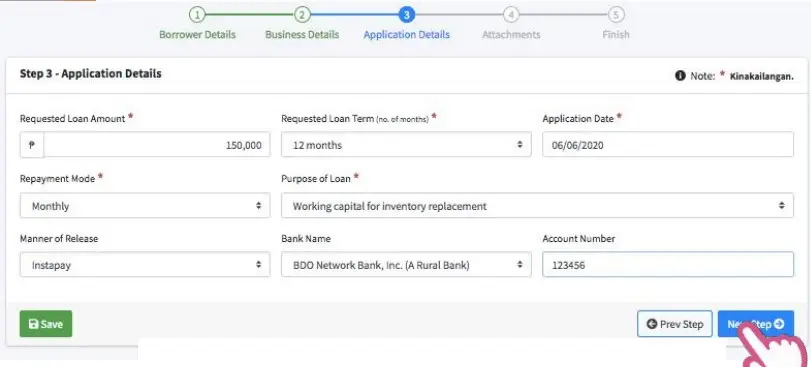

Here’s a filled-in version of the 3rd page of the form for your reference:

Source: BRS Instruction Manual

3. Complete Application Form

The application form is the most critical requirement for a DTI loan. Ensure you provide comprehensive and accurate business information, including your business name, registration details, and chosen loan program.

While there might be a temptation to exaggerate some details to present your business in a better light, you must remember that honesty is always the best policy.

Remember to review all information thoroughly before submissions. Take your time to fill out the form, and don’t be afraid to seek assistance if needed. Accuracy is more important than speed, as errors could lead to delays or rejection.

4. Upload all Required Documents

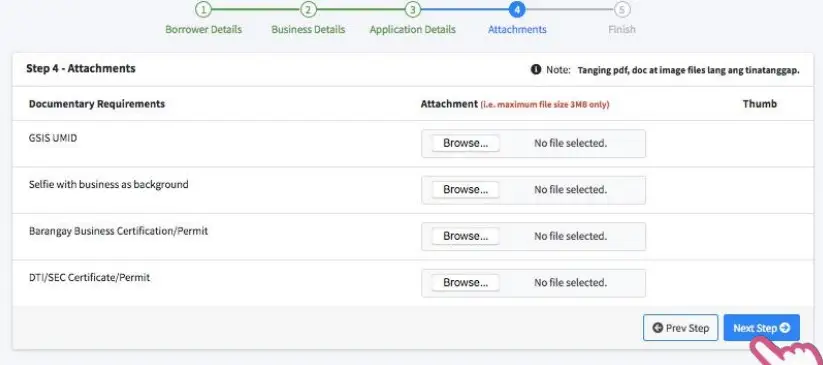

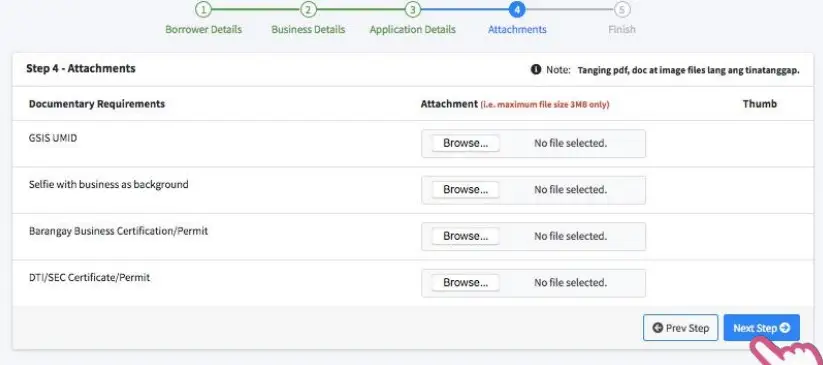

DTI loans typically require specific documents to support your application, such as business or barangay permits, financial statements, and project proposals. You should organize your documents neatly and upload them according to the provided guidelines, keeping in mind that the maximum file size per upload is 3 MB.

Here’s a picture of the uploading step for your reference:

Source: BRS Instruction Manual

5. Submission and Confirmation

After completing the application form and uploading the necessary documents, submit your application. You should receive a confirmation indicating that they’ve received your application. Be patient, as DTI may require time to review your submission.

Stay vigilant for any updates or inquiries from the agency. Check your email and be prepared to provide additional information if requested.

How to Apply DTI Loan Online: Key Steps for a Successful Application

Securing funding is crucial for small business growth, and understanding how to apply DTI loan online can streamline the process. Whether you're launching a profitable business in the Philippines or expanding an existing venture, following these key steps ensures a smooth loan application:

-

Check Your Eligibility – Ensure your business meets the Department of Trade and Industry's (DTI) criteria, whether you run a sole proprietorship business in the Philippines or a registered corporation.

-

Prepare Your Business Plan – A strong business plan for loan applications should outline financial projections, repayment strategies, and growth plans. This improves approval chances and showcases your business's potential.

-

Complete the Online Application – Visit the official DTI website and follow the instructions on how to apply DTI loan online by submitting the required documents, including financial statements and business registration details.

-

Understand Loan Terms – Compare options like short-term vs. long-term loans, evaluate interest rates, and review repayment plans to select the best financing solution for your needs.

-

Monitor Application Status – Keep track of your loan application and be prepared to provide additional documents if required. Securing sme financing in the Philippines often requires thorough documentation and follow-ups.

By following these steps, business owners can leverage DTI loans to overcome small business financial challenges, ensuring sustained growth and success.

Final Thoughts

Access to the right funding is a game-changer for businesses, whether you’re launching a startup, managing an expanding SME, or exploring new investment opportunities. While private vs. government business loans each have their advantages, understanding business loan benefits and creating a business loan repayment plan can ensure financial stability and long-term success.

For those looking for alternative financing beyond DTI loans, Zenith Capital offers fast, flexible, and hassle-free business funding in the Philippines. Whether you need capital for inventory, expansion, or day-to-day operations, we provide tailored solutions to help you thrive in a competitive market.